Mankind’s quest for a cashless society started thousands of years ago, when the first human settlements were found in Jebel Irhoud, Morocco.

Also termed as a Barter system, it would soon become the most accepted means of a transaction, right from the Cenozoic era of the Homo sapiens some 300,000 years ago to the end of Middle ages 6 centuries ago.

After all these years, as we inch towards a Type 1 civilization of the Kadarshev scale, the DNA of our prehistoric ancestors is once again urging us to become a cashless society.

First came the credit cards in the 1990s, followed by e wallets in the 2000s, mobile or UPI payments in 2010s and human microchipping in 2020s.

While human microchipping is still a controversial subject, full fledged trials have already begun in Sweden, Belgium and Denmark to implant humans (as well as pets) with silicon chips.

Till the time it is considered safe for global population, we have to be content with mobile payments or e wallets.

Mobile POS payments are in no way inferior to digital payments, with the COVID-19 crisis ravaging and plundering precious human lives, mobile based Account to Account Real Time Payment (A2A RTP) systems have gained more significance than ever before.

According to Statista, mPOS has grown by 39% from 2019 to $1,581,701 million transactional volume in 2020, with more than 1172 million users across the globe, a 30% increase from 2019.

This amazing growth, especially on Android phones,is primarily driven by two of the mobile payment options: Samsung Pay and Android Pay.

Both of them arrived in the market in September 2015 and since then, they have established themselves as market leaders through partnerships with retailers and countless financial institutions.

One of the main differences between Android Pay and Samsung Pay, is the devices that support either of the two mobile payment options.

Samsung Pay is available on Samsung smartphones that have an Android version KitKat 4.4 and later.

This is mostly on the Samsung Galaxy smartphones.

This means if you prefer using Samsung Pay instead of Android pay, buying a Samsung smartphone is your only option.

Other select Samsung mobile phones can also support Samsung Pay if their operating system is upgraded to a newer version.

Android Pay, on the other hand, is not limited to platforms.

So long as you have an Android phone, Android Pay will be supported on your phone.

The only limit it has is on Apple’s devices, but all the other smartphones with Android OS can support Android Pay and this is a huge difference between Samsung Pay and Android Pay.

This means you can have Samsung Pay and Android Pay both on your phone if you have a Samsung smartphone and you can use the one you want at any time.

Another emerging difference between the two is the number of retail locations and banks/financial institutions they work with.

Samsung Pay works with more retail locations as compared to Android Pay.

But it also works with a small number of banks and cards as compared to its counterpart Android Pay.

At its launch, Samsung had Bank of America, U.S Bank and Citi on board as well as American Express, Master Card and Visa.

When you add a card via Samsung Pay, you get the same experience between all the cards, unlike in Android Pay where you can add a card,but it’s not fully supported.

With Samsung Pay, once you add the card to the app, it works flawlessly.

With Android Pay, not all card types or banks are supported and this leads to some confusion.

Before you add a card to Android Pay, contact your bank first to ensure it is fully supported.

Android Pay supports loyalty and gift cards, all you have to do is just enter them into the Android Pay app and it displays them on your screen as a bar-code to be scanned by the merchant.

You can’t manually enter any number or merchant like it used to happen with Google wallet but you can only add gift cards from programs recognized by the system.

Android Pay uses NFC (Near Field Communication) technology hardware that is available on Android phones.

To complete a purchase, a signal from the NFC hardware on compatible Android phones is used or Android Wear-based smartwatch, to a retailer POS terminal.

You can also use Android Pay online together with the supported apps and there are retailers who support purchasing items online via Android Pay using Google Chrome web browser.

One of the other significant differences between Samsung Pay and Android Pay comes in the technology they use.

As mentioned above, Android Pay uses NFC technology and so does Samsung Pay.

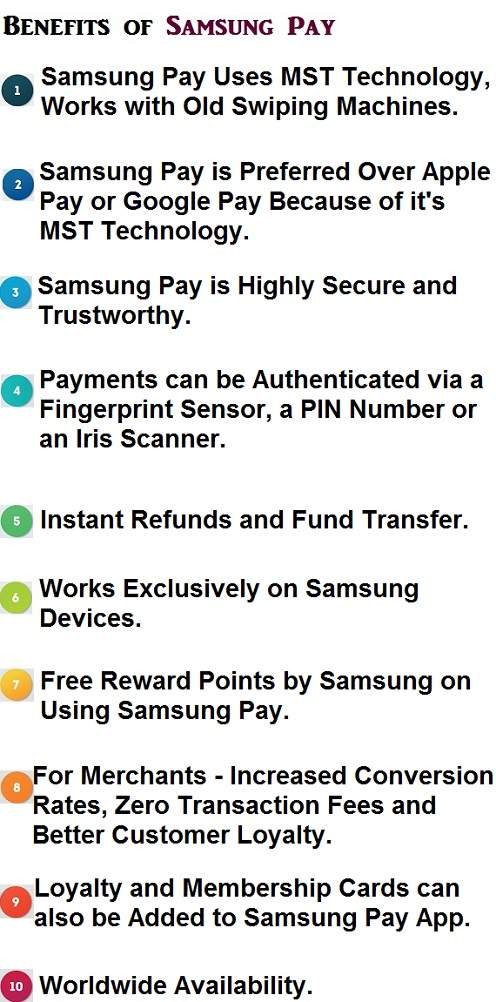

However, the difference is in the addition of Magnetic Secure Transmission (MST) technology in Samsung Pay.

This means you can use your supported phone or watch and make payments on the Point of Sale systems that use the older MST technology.

This is the same technology used on debit and credit cards with their magnetic stripe on the back.

This allows Samsung Pay to be used by as many retailers as possible as compared to its rival Android Pay.

Samsung is also installing a magnetic coil inside some of its recent Galaxy smartphones.

The field created by the coil combined with the Samsung Pay app can be used to transmit payment signals to standard credit card terminals using MST technology.

All these mobile money have distinct features making them different in their own way.

The choice on the service to use is dependent on the user.

But if you have a Samsung device that can support both Android Pay and Samsung Pay, use them and add your cards on both to use depending on the situation you are in.