Flashing a credit card at the Walmart does not get you the same respect, like it used to some 20 years ago, worse if you show them cash.

More often than not, the billing counter executive always smiles at you, if you happen to make a payment through PopMoney, Venmo or Zelle, because he or she considers you as a smart, intelligent person.

Unfortunately, Americans stick to their cards, like wet paint to the floor… old habits die hard.

It’s been more than 13 years since the first mobile wallet, Amazon Pay was introduced in the US, would you believe that after all these years, Apple has released a physical Apple Card in August 2019?

However, this has proved three things…

1, Americans trust their plastics more than the mobile wallets.

2, Integrating UPI or Unified Payments Interface into 6500 plus private American banks would cost both the banks and wallet providers millions of dollars.

3, The value proposition of UPI payments in the US is very low.

1, Americans trust their plastics more than the mobile wallets –

From buying an ice cream to paying for a car wash, Americans love to swipe their plastic, because the more they spend, higher the bonus and discounts they receive from the credit card companies.

Which obviously leads to something called as ‘line of credit’ also called as a ‘credit score’, where credit card issuing banks give instant mega loans for buying a house or a car, to those card holders who repay their debts on time, every single month.

2, Integrating UPI or Unified Payments Interface into 6500 plus American private banks is almost impossible –

Even though the US government sets up banking regulations, private players are least bothered about it and set their own regulations, best suited for their profit.

Besides, mobile wallets such as Apple Pay or Google Pay had already been in touch with private banks, but they are not very keen to integrate their internet banking features with mobile payment agents, as they don’t see much of a profit but more of an expense in maintaining them.

3, The value proposition of UPI payments in the US is very low –

Unlike Asia where ATM machines are in great demand, the US has no dearth for neither ATM machines nor for Electronic Data Capture (EDC) machines, which are used for swiping credit and debit cards.

Then why use mobile wallets when you can do the same with credit cards with added benefits?

Exactly, that’s the argument of millions of US credit card holders, for not switching over to UPI payments.

Let us take a look at two of biggest Account to Account Real Time Payment (A2A RTP) providers in USA, namely, Apple Pay and Samsung Pay.

It is a well known fact that Apple Pay and Samsung Pay are the only two mobile payment providers, who offer their services exclusively to their smart phone users.

You won’t find them on Google Play Store, even though Samsung works on an Android based operating system.

Availability

When Apple Pay was first announced in September 2014, its services did not begin until the following month, October.

It was available on the iPhone 6 and iPhone 6 plus at the time, but it expanded to include the latest iPhones, Apple watches, and the company’s MacBook Pro laptop that uses a touch identification feature.

On the brand’s iPads, the service is available through an app.

On the other hand, Samsung emerged in the market in 2015 and it is available on Galaxy phones as well as Gear S2 and Gear S3 smartwatches.

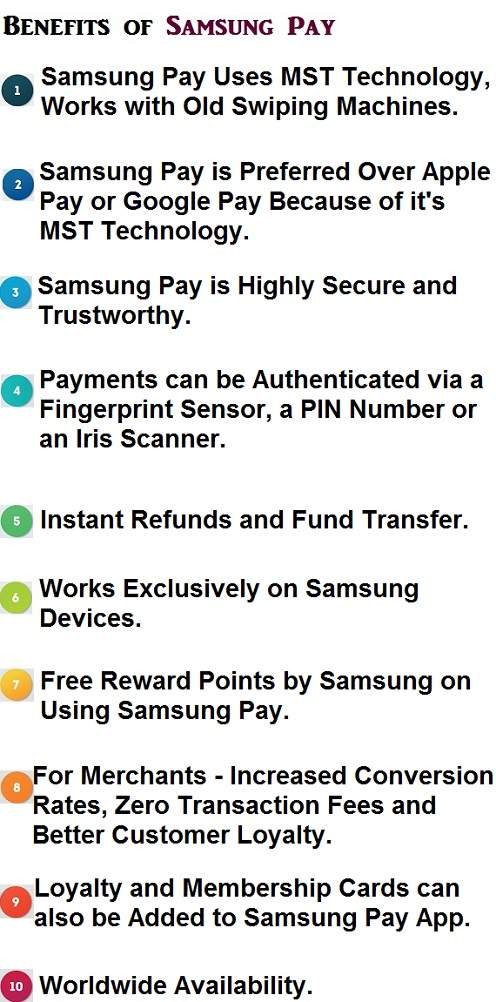

Samsung Pay also uses NFC at various terminals and old credit card machines access the service via MST (magnetic fields).

Security

In a world where people are reluctant to trust their wallets with not-so-flawless devices, security is paramount.

Though both brands use tokenization method for confidentiality where third parties are concerned, their respective devices carry precautionary measures that limit access to individual accounts.

For Samsung Pay, fingerprint scanning is a must.

It is by far the most secure way for users to keep their account hidden from greedy hackers.

Apple Pay, however, has included a facial recognition feature and they are working on a hardware-based mechanism that will prevent any tampering.

How To Use Them

Once you have access to the Samsung Pay app and open it.

While older Samsung gadgets rely on fingerprints or PINs for verification, the newer models require the former option.

Your next step is to add debit and credit cards and since manual-information feeding is exhausting, Samsung allows one to find their card numbers automatically via Viewfinder.

The final step includes verifying the cards through an email or a text message with Apple Pay, you just take a picture of your card and the device does the rest.

Transaction Data

Mobile payment providers like Apple and Samsung make use of information like location and phone usage to market their brand, reach their clients, or improve their services through inquiries.

The information is also important to users for budgeting.

Unlike Apple Pay, Samsung tracks and stores data that can only be accessed by the user.

After every purchase, one receives a notification with details about the trade.

According to various reports, Apple pay does not track usage; instead, they left it in the hands of customers, vendors, and banks.

Globally, Samsung is more popular than Apple. As mobile payment providers, the latter has a lead and it is estimated to have attracted more than 150 million users by 2017.

Research shows that though Apple has a lead in the contactless payment market, it has not yet firmly established it’s services in Africa, Europe, and Asia.

The brand had a head start in adding retailers, banks, and countries but it still has a long way to go.

Samsung gains a competitive advantage due its affordability and ease of access.

While iPhones cost a fortune, one can purchase a Samsung Galaxy 6 for as little as $150.

Besides, the number of Apple stores across the globe is less than that of Samsung.

With both services, only the client can limit usage; however, Apple Pay users transact faster than Samsung.

With the later, one has to pick the card before finalizing the purchase while the former requires only fingerprint verification and you can be on your way.

So far, Apple Pay is still relying on NFC (Near Field Communication) exclusively.

The brand has plans to surpass the technical challenge by manipulating their devices but until then, Samsung Pay has a lead since it can use magnetic stripes.

Currently, the LoopPay technology adopted by Samsung allows users to transact at any old terminals that lack NFC-based magnetic stripe card readers.

Security wise, iPhone X has the latest upgrade from fingerprint scanning to facial recognition during payments.

The company is also investing in Apple Pay Cash as it launches the iOS 11.2. The service will allow clients send money through the iMessage app.

The world is yet to see how both brands upgrade their services to improve their market share.

Despite their differences, each is committed to improving their customers’ experiences and providing world-class assistance without failing.

Security is still a major issue and it is the duty of a user to notify their banks in case one loses their phones or notices discrepancies in their accounts.