It is a well known fact that credit and debit cards are soon going to be as obsolete as a floppy disk or a CD player, whereas human microchipping and mobile based Unified Payment Interface (UPI) systems are going to be the future of digital payment technology.

Not only do these UPI or Account-to-Account Real Time Payment (A2A RTP) systems expedite the payment processing time but they are far more secure than the age old chip based credit card technology.

While the entire world is shifting towards A2A RTP gateways, USA seems to be heading in the opposite direction, where both baby boomers and millennials alike prefer card based transactions over the P2P (Peer to Peer) transactions.

American addiction to card based transactions has forced mobile payment providers such as Google and Apple to introduce a physical card, which defeats the very purpose of developing a mobile wallet.

Apple introduced Apple Card in August 2019, in association with Mastercard and Goldman Sachs, exclusively for iPhone users in United States.

While Google had a similar one, called Google Wallet card in 2013, which was abandoned in 2016 and will soon make a comeback in 2021.

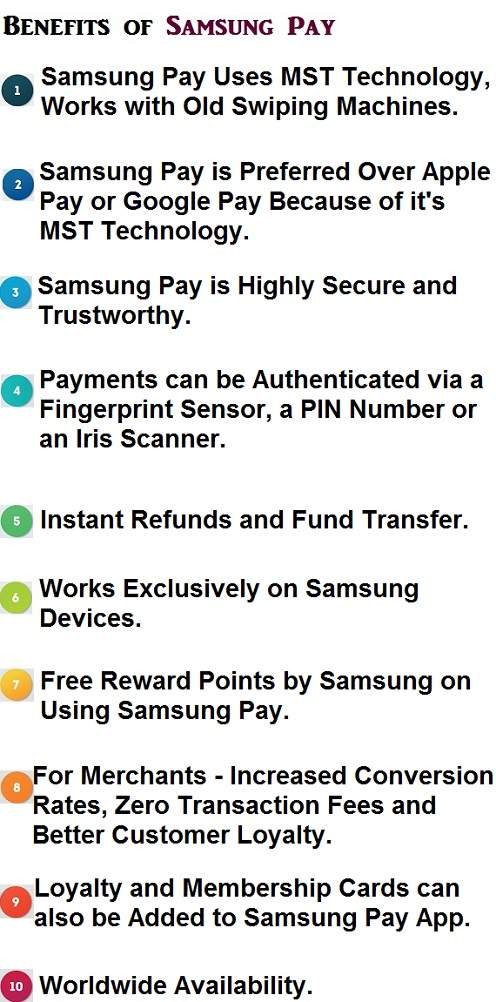

Samsung, on the other hand, has no such plans, but still a formidable force in South and Far East Asia.

Apart from supporting UPI payments in countries like India, South Korea, China, Thailand and Hong Kong, one can use Samsung Pay to buy bus tickets in China, withdraw cash from South Korean ATMs and store loyalty cards of any establishment across the globe.

Service

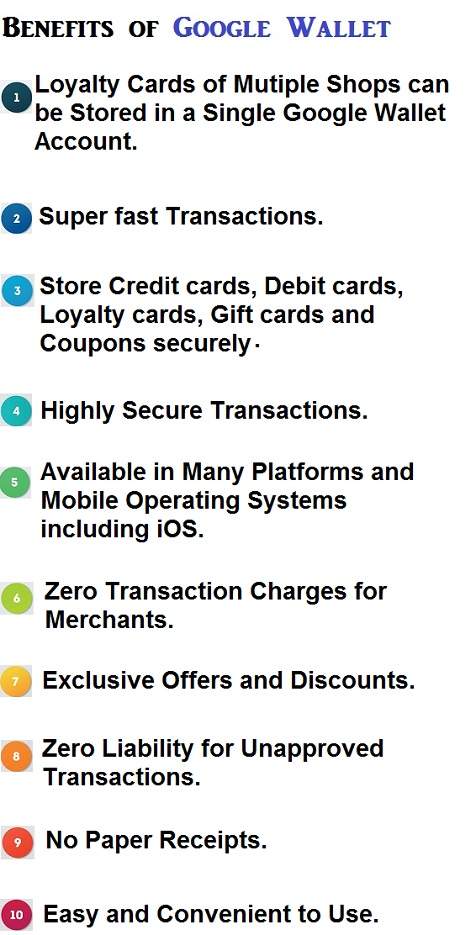

Google Wallet is designed to allow users to send money to and fro by entering the recipient’s email address or phone number which is linked to the bank in question and funds are transferred directly between accounts.

One can include more than one bank while signing up for the service. A four-digit PIN number is required for security purposes.

Instead of using your original card, a virtual wallet card is processed and it becomes your go tickets while shopping online or purchasing items from vendors with active Google Wallet accounts.

Despite being discontinued on June 30, 2016, the Google Wallet app was later merged with Android Pay and together they will function under the name Google Pay as of January 8, 2018.

Samsung Pay serves both a mobile payment provider and a digital wallet. Apart from supporting contact-less payments using NFC, the service uses magnetic fields as well.

The acquisition of LooPay technology by Samsung has allowed users to transact on systems that only support magnetic stripes too.

The development has expanded the brand’s merchants to include old terminals that lack Near Field Communications.

Unlike Google Wallet, the app is easy to use and less complicated to understand. All one has to do is tap and swipe over a POS system.

It is also a crucial payment tool used by online stores, however, client information is not revealed to the vendors.

Security

Google Wallet stores data in a cloud system where information is encrypted with an SSL(secure socket layer) technology that’s globally approved and tested.

To access your app, one must provide a four-digit PIN number; when multiple trials are detected, the account is temporarily disabled until proper procedures are followed to reactivate it again.

A general passcode is recommended for additional security on mobile phones.

Where one is required to verify their identity for certain transactions, visit the Wallet website for accuracy.

Failure to do so, the federal government assigned to monitor and ensure financial regulations are followed to the core will be knocking at your door.

Loss of the Google Wallet card should be reported and canceled immediately through myaccount.google.com.

Security in Samsung Pay is more pronounced than with Google Wallet. So far, their latest development falls under fingerprint scanning.

Add that to the tokenization method that ensures clients confidentiality in terms of personal information.

Also, their devices happen to carry the latest technology advancements on top of being sophisticated.

However, Google’s cloud system outmatches Samsung security system by far.

Their servers are secured under numerous well-established encryptions that have survived major cyber-attacks and still stand strong.

Availability

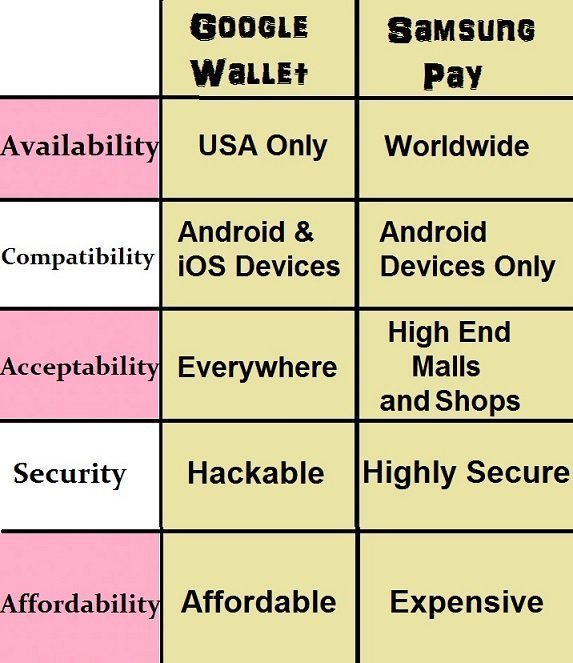

Device-wise, Google Wallet is compatible with Androids running with the 4.0 version and above or the iOS devices running with the 7.0 version and above as well.

They are both cheap and widely spread around the world. Samsung Pay is limited to Galaxy-based phones and the brand’s smartwatches (Gear S2 and S3).

Language-wise, Samsung has yet to adopt the multilingual system. Google Wallet, on the other hand, comes in more than 30 tongues.

As of November 21, 2017, Samsung Pay is available in 22 countries including India, US, Canada, South Korea, Vietnam, Mexico, and Belarus among others.

Despite Google’s popularity, it’s wallet services are yet to go beyond the United State and the United Kingdom.

It has the potential to tap into a large market since most of the world’s population own android phones but the company has had some minor setbacks while trying to upgrade to Android Pay.

Both brands are still new to the digital market.

In the few years they have competed alongside each other, Google appears to have a higher market share compared to Samsung Pay.

The latter has limitations where compatibility is concerned while the former is stuck between upgrading and merging.

Compared to Androids, original Samsung products are fairly expensive. Today, one can easily purchase an exact copy of a Galaxy Note only to realize later that it is another OS inside a Galaxy casing.

Technically, Samsung is more advanced due to the quality of it’s gadgets.

Since Galaxy models swamped the mobile market, the older and younger generation wants to purchase one even though they are expensive.

However, the devices will soon lose their touch in the near future when Near Field Communication chips find their way in every Android.

To say one payment method is better than the other is tricky but each has its pros and cons.